Introduction: Why Year-End Closing Determines Your Business Health

Most Indian businesses treat year-end book closing as a routine accounting task – something to rush through so they can file their returns and move on.

This is a costly mistake.

Year-end book closing isn’t just about compliance. It’s your business’s annual health report that determines:

- Your actual tax liability (not estimated, but actual)

- Audit risk and scrutiny probability

- Loan and credit eligibility

- Investor confidence and valuation

- GST refund eligibility

- Financial decision-making for the next year

In India, the April-June period becomes the most stressful time for businesses because everyone is simultaneously dealing with:

- GST annual returns and reconciliations

- Income Tax return filing

- Statutory audit requirements

- ROC/MCA filings

- TDS return corrections

- Financial statement finalization

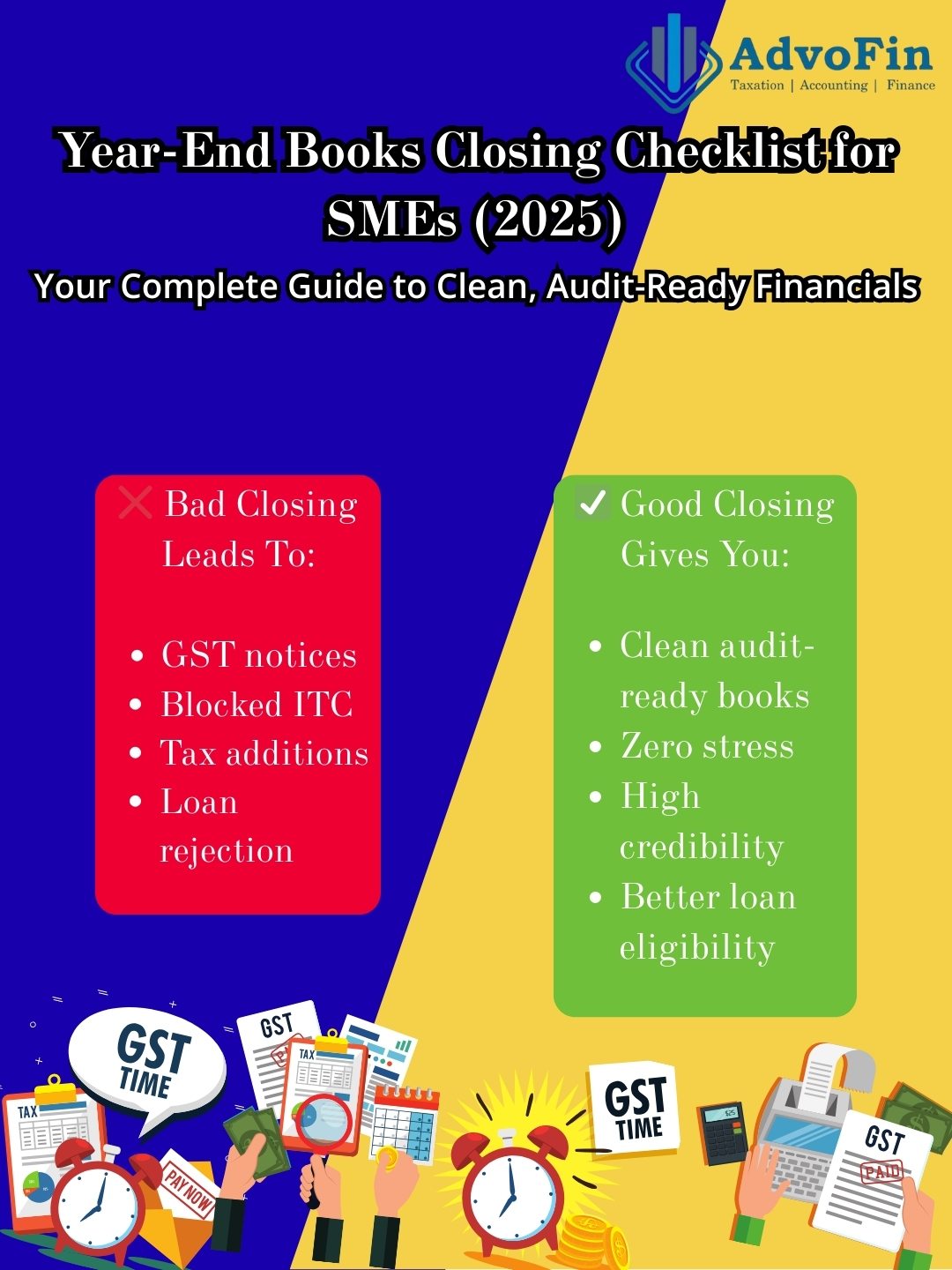

If you skip critical steps or delay closing your books properly, you expose yourself to:

❌ GST mismatch notices and ITC reversals

❌ Income tax additions and disallowances

❌ Increased scrutiny and audit risk

❌ Penalties, interest, and late fees

❌ Delayed audits affecting next year’s filing

❌ Inaccurate financial statements damaging credibility

This comprehensive guide gives you a step-by-step, founder-friendly Year-End Books Closing Checklist – specifically designed for SMEs, startups, and growing businesses that want clean, audit-ready books without the chaos.

Let’s break it down systematically.

PART A: GST Year-End Closing (Critical for ITC and Compliance)

1. Reconcile GSTR-2B with Your Purchase Register

This is where most businesses lose money – sometimes lakhs in blocked ITC.

What to Do:

- Download GSTR-2B for all 12 months

- Match every purchase invoice in your books with 2B entries

- Create a vendor-wise ITC reconciliation sheet

- Identify missing invoices (where vendor didn’t file or filed incorrectly)

- Mark “Deferred ITC” separately for invoices not yet appearing in 2B

Common Issues to Watch:

- Vendor filed GSTR-1 but in wrong period

- Invoice amount mismatch (₹1,00,000 in your books vs ₹1,10,000 in 2B)

- Vendor’s GSTIN suspended or cancelled

- Duplicate entries

- Wrong HSN codes causing mismatch

Result: Your ITC claim becomes audit-proof and you can follow up with non-compliant vendors for missing credits.

Pro Tip: Don’t claim ITC based on invoices alone. Only claim what’s in GSTR-2B. This prevents 90% of ITC-related notices.

2. Reconcile GSTR-1, GSTR-3B, and Your Sales Register

The Golden Rule: Turnover in your GST returns MUST match turnover in your books. Any mismatch is an automatic red flag.

Reconciliation Checklist:

| Item | GSTR-1 | GSTR-3B | Books | Must Match |

| B2B Sales | Table 4 | Table 3.1(a) | Sales register | ✓ |

| B2C Sales | Table 5 | Table 3.1(b) | Sales register | ✓ |

| Credit Notes | Table 9B/9C | Table 4(B) | Sales return | ✓ |

| Tax Liability | – | Table 3.2 | GST payable | ✓ |

| ITC Claimed | – | Table 4(A) | GSTR-2B matched | ✓ |

Common Mismatches to Fix:

- Sales invoice entered in wrong month

- Credit notes not adjusted properly

- Export sales not classified correctly

- Nil-rated supplies not recorded properly

- RCM liability not booked in books

Why This Matters: GST analytics systems automatically flag businesses where GSTR-1 and GSTR-3B don’t match or where GST returns don’t align with Income Tax returns.

3. ITC Eligibility Review (Section 16 & 17(5) Check)

Not all ITC claimed is legally eligible. Year-end is the time to review and reverse ineligible credits.

Critical Questions to Ask:

For Each ITC Claim:

Did you actually receive the goods/services?

Is the tax invoice compliant (all mandatory fields present)?

Has the vendor filed their GSTR-1?

Is the ITC reflected in your GSTR-2B?

Did you pay the vendor within 180 days? (If not, reverse ITC)

Blocked ITC Under Section 17(5): You CANNOT claim ITC on:

- Motor vehicles (except specified uses)

- Food, beverages, outdoor catering

- Health services, cosmetic treatments

- Rent-a-cab services

- Life and health insurance

- Travel benefits to employees

- Membership of clubs, gyms

- Personal use items

Action Items:

- Review all ITC claimed during the year

- Reverse blocked ITC immediately

- Check vendor payment dates – reverse ITC if payment delayed beyond 180 days

- Reclaim reversed ITC when payment is made

Consequence of Not Doing This: During GST audit, ineligible ITC will be added to your liability with 18% interest from the date of claim.

4. GST Ledger Reconciliation (Electronic vs Books)

The GST portal maintains three electronic ledgers for your GSTIN. These must match your books.

Reconciliation Required:

| GST Ledger | What It Shows | Must Match With |

| Electronic Cash Ledger | GST paid in cash | Bank payments/challans |

| Electronic Credit Ledger | ITC available | ITC claimed in books |

| Electronic Liability Ledger | Tax liability | GST payable in books |

How to Do This:

- Login to GST portal

- Go to Services > Ledgers

- Download all three ledgers for FY 2024-25

- Match with your GST control accounts in books

- Investigate and fix any differences

Common Issues:

- Challan paid but not reflecting (wrong GSTIN used)

- ITC auto-reversed by system not recorded in books

- Interest/penalty/late fees not accounted for

- Manual journal entries without actual portal transaction

5. E-Way Bill and E-Invoice Compliance Review

For Businesses Required to Generate E-Invoices:

All B2B invoices above threshold have IRN (Invoice Reference Number)

QR codes generated and present on invoices

E-invoice portal data matches GSTR-1

Cancelled invoices properly handled

For All Businesses Moving Goods:

E-way bills generated for all interstate movements

E-way bill details match invoice details

Vehicle numbers correctly updated

No expired e-way bills during transit

Transporter GSTIN verified and valid

Why This Matters: Anti-evasion wing conducts random checks. Missing e-way bills can result in penalties up to 200% of tax value plus detention of goods.

PART B: Income Tax Year-End Closing

6. Books vs TDS Reconciliation (Form 26AS Matching)

TDS mismatches are one of the fastest ways to get a scrutiny notice.

Reconciliation Steps:

Step 1: Download Form 26AS

- For the company (TAN-based)

- For all directors/partners (PAN-based)

Step 2: Match TDS Deducted (You as Deductor)

- Compare 26AS with your TDS returns (24Q/26Q/27Q)

- Verify every challan is reflected

- Check for any missing or duplicate entries

- Ensure section codes are correct

Step 3: Match TDS Credits (You as Deductee)

- Compare TDS shown in vendor invoices with your 26AS

- Identify missing TDS credits

- Follow up with vendors who deducted but didn’t file returns

Step 4: Check TDS Receivable

- TDS deducted on you but not yet credited in 26AS

- Track these amounts separately

- Claim when they appear in 26AS

Consequence of Mismatch:

- Your refund gets stuck

- Additions made to income

- Vendor disputes

- Interest and penalty exposure

7. Fixed Asset Register Update (Critical for Depreciation)

Your fixed asset register determines depreciation claims – which directly affects your tax liability.

Year-End Fixed Asset Checklist:

Additions:

All new assets purchased during the year recorded

Purchase invoices and payment proof maintained

Assets put to use date recorded

Correct depreciation rate applied (as per Income Tax Act)

Half-year rule applied for assets used < 180 days

Deletions:

Assets sold or scrapped recorded

Sale consideration and capital gain calculated

Asset removed from depreciation schedule

Profit/loss on sale accounted for

Capital Work in Progress (CWIP):

Assets under construction/installation separately tracked

No depreciation claimed until put to use

Capitalization date determined

Depreciation Schedule:

Rate-wise asset grouping (computers 40%, furniture 10%, etc.)

Block of assets maintained correctly

Written down value (WDV) calculated accurately

Why This Matters:

- Affects your taxable income significantly

- Determines tax audit eligibility (depreciation > ₹25,000 requires books)

- Critical for investor and bank due diligence

8. Loan, Cash, and Bank Reconciliation

Bank mismatch is the #1 reason for errors in tax audits and financial statements.

Bank Reconciliation:

Download bank statements for all accounts for entire FY

Match every entry with books

Identify and record:

- Bank charges not yet recorded

- Interest credited/debited

- Direct debits/credits

- Cheques issued but not presented

- Deposits in transit

Prepare bank reconciliation statement (BRS)

Zero unreconciled balance is the goal

Cash Reconciliation:

Physical cash count on 31st March

Must match cash book closing balance

Large cash balances need explanation

Check for cash payments exceeding ₹10,000 (disallowed u/s 40A(3))

Loan Reconciliation:

Match loan ledgers with bank statements

Update principal and interest separately

Record EMI payments correctly

Check for any prepayment charges

Obtain loan confirmation certificates from lenders

9. Debtors and Creditors Review (Ageing and Confirmations)

Debtors (Accounts Receivable):

Create Ageing Analysis:

| Age Bracket | Amount Outstanding | Action |

| 0-30 days | ₹X | Normal follow-up |

| 31-90 days | ₹Y | Escalated follow-up |

| 91-180 days | ₹Z | Legal notice consideration |

| 180+ days | ₹A | Bad debt provision |

Action Items:

Send confirmation requests to all debtors

Reconcile debtor ledgers with their records

Identify bad debts (unrecoverable amounts)

Create provision for doubtful debts

Write off confirmed bad debts (with approval)

Creditors (Accounts Payable):

Obtain balance confirmations from suppliers

Reconcile creditor ledgers

Identify old outstanding amounts needing clarification

Check for any disputed amounts

Verify ITC claimed matches creditor balances

Why This Matters:

- Improves working capital management

- Reduces audit queries

- Strengthens financial ratios for loans

- Prevents revenue leakage

10. Inventory Closing and Valuation

Inventory valuation directly impacts your profit, tax liability, and GST compliance.

Physical Stock Verification:

Conduct full physical stock count on 31st March

Count all raw materials, WIP, finished goods

Record damaged/obsolete stock separately

Investigate and document any discrepancies

Valuation Method:

Use consistent method (FIFO or Weighted Average)

Cannot switch methods without disclosure

Value at lower of cost or net realizable value

GST Considerations:

Ensure ITC claimed only on stock actually received

Check for goods received but invoice pending (GRN vs Invoice)

Reverse ITC if goods not received within 180 days

Account for job work inventory

Impact on Financials:

- Opening stock + Purchases – Closing stock = Cost of Goods Sold

- Incorrect closing stock = wrong profit = wrong tax

Documentation:

- Maintain stock sheets with item-wise details

- Keep photos/videos of physical verification

- Document valuation methodology

PART C: Financial Statements Finalization

11. Profit & Loss (P&L) Statement Scrutiny

Your P&L should tell a clean, consistent story. Year-end is time to catch anomalies.

Red Flags to Review:

Abnormal Spikes:

- Suddenly high expenses in Q4 (March)

- Revenue concentrated in one month

- Unusual one-time expenses

Personal Expenses Wrongly Booked:

- Family travel as business travel

- Personal vehicle expenses

- Home expenses (unless genuine home office)

- Personal insurance in business books

Cash Payment Violations:

- Any single payment > ₹10,000 in cash (disallowed u/s 40A(3))

- Exceptions: transport, agriculture, petty expenses

Non-Deductible Expenses:

- Expenses where TDS not deducted/deposited (40(a)(ia))

- Statutory payments delayed beyond due date (43B)

- Penalties and fines

- Personal expenses

Revenue vs Capital:

- Repairs vs renovations (revenue vs capital)

- Software license vs software purchase

- Correct classification affects depreciation vs immediate expense

Action: Remove or reclassify any problematic expenses BEFORE finalizing books.

12. Balance Sheet Cleanup (Zero Suspicious Items)

Your balance sheet must be clean with every item explainable.

Critical Areas to Review:

Director/Partner Loans:

All director loans properly documented

Interest charged if required (if loan exceeds certain limits)

Check Section 2(22)(e) deemed dividend implications

Obtain signed confirmations

Shareholder Funds:

Share capital properly recorded

Share premium accounted correctly

Reserves and surplus accurate

Suspense/Temporary Accounts:

Clear all suspense accounts

Zero balance in temporary accounts

All entries properly classified

Provisions and Liabilities:

Provision for expenses accurate

Bonus provision matches actual payout plan

Audit fees provision reasonable

Advances:

Advances to vendors reconciled

Advances from customers recorded

Long-outstanding advances investigated

Goal: Zero unexplained credits, no unidentified transactions, complete clarity.

13. GST Impact on Books (Ledger Alignment)

Your books must reflect GST properly as a separate line item, not mixed with revenue/expenses.

Key Adjustments:

ITC Ledger Closing:

ITC claimed matches GSTR-2B

Ineligible ITC reversed

ITC reversal for unpaid invoices recorded

RCM (Reverse Charge Mechanism):

All RCM liabilities booked

RCM paid within due dates

Both liability and ITC recorded correctly

GST Receivables:

Refunds claimed tracked separately

Excess payment tracked for future set-off

GST Payables:

All pending GST liabilities recorded

Interest on late payment accounted

Penalties and late fees recorded

Important: GST should never be part of sales or purchase value in books – it should always be separate ledger accounts.

PART D: Internal Controls and Documentation

14. Internal Audit (Optional But Highly Recommended)

A quick internal audit before statutory audit catches issues early.

What Internal Audit Covers:

Fraud Detection:

- Duplicate vendor payments

- Ghost employees on payroll

- Fake invoices

- Cash leakages

Vendor Issues:

- Non-compliant vendors (not filing GST)

- Suspicious vendor patterns

- Vendor payment delays affecting ITC

Documentation Gaps:

- Missing invoices

- Incomplete contracts

- No vendor agreements

- Poor expense documentation

GST Under-Reporting:

- Sales not recorded

- Cash sales hidden

- B2C sales shown as exempt

TDS Errors:

- Wrong rates applied

- Late deposits

- Missing deductees

Benefits:

- Fixes issues before statutory audit

- Reduces audit time and cost

- Prevents embarrassing discoveries

- Strengthens financial controls

15. Audit Defense File Preparation

Create a comprehensive file containing all documents your auditor will need. This speeds up audit and reduces queries.

Documents to Compile:

GST Documentation:

- GSTR-1, 2B, 3B for all 12 months

- ITC reconciliation workings

- Vendor compliance tracker

- E-way bill and e-invoice reports

Income Tax Documentation:

- Form 26AS (TAN and PAN-based)

- TDS returns (24Q, 26Q, 27Q)

- TDS payment challans

- Advance tax payment proof

Financial Documentation:

- Complete ledger extracts

- Bank statements and BRS

- Stock sheets and valuation working

- Fixed asset register

- Debtor/creditor confirmations

Compliance Proof:

- Board resolutions

- Statutory payment receipts

- ROC filings

- Professional tax, PF, ESI challans

Contracts and Agreements:

- Vendor contracts

- Customer agreements

- Lease/rent agreements

- Loan agreements

16. Management Review and Financial Analysis

Before you close the books, step back and analyze your business performance.

Key Metrics to Review:

Profitability:

- Gross profit margin (GP/Revenue)

- Net profit margin (NP/Revenue)

- EBITDA

- Trends vs previous year

Liquidity:

- Current ratio (Current Assets/Current Liabilities)

- Quick ratio

- Cash flow from operations

Efficiency:

- Debtor turnover (how fast you collect)

- Creditor turnover (payment cycles)

- Inventory turnover

- Asset utilization

Leverage:

- Debt-to-equity ratio

- Interest coverage ratio

Insights This Provides:

- Which products/services are most profitable

- Where cash is stuck

- Which expenses need control

- Whether you’re growing sustainably

This analysis becomes the foundation for next year’s strategy.

PART E: Strategic Planning for Next Year

Year-end book closing isn’t just backward-looking compliance – it’s forward-looking strategy.

17. Decisions Based on Your Closed Books

Tax Structure Decisions:

- Should you continue with normal taxation or switch to presumptive (44AD/44ADA)?

- Is your current entity structure (proprietorship/LLP/Pvt Ltd) still optimal?

- Should you split operations for tax efficiency?

Compliance Structure:

- Should you hire an in-house accountant or continue outsourcing?

- Do you need monthly CA support or quarterly is enough?

- Should you implement accounting software with better controls?

Financial Planning:

- How much advance tax to pay next quarter?

- Can you improve cash flow cycles?

- Where to reduce expenses without hurting operations?

- Investment planning for tax savings

Growth Planning:

- Can you afford to hire more people?

- Is your working capital sufficient for growth?

- What’s your borrowing capacity?

- Are margins healthy enough to scale?

Clean books give you confidence to make these decisions with data, not guesswork.

The Complete Year-End Closing Timeline

By 15th April:

Complete all March entries

Bank reconciliation done

GST filing for March completed

TDS return for Q4 filed

By 30th April:

Physical stock verification completed

Fixed asset register updated

Debtor/creditor confirmations sent

By 15th May:

All reconciliations completed (GST, TDS, Bank)

P&L and Balance Sheet drafted

Internal review done

By 31st May:

Finalize financial statements

Audit defense file prepared

Hand over to statutory auditor

By 30th June:

Statutory audit completed

Tax audit completed (if applicable)

Income Tax return filed

By 31st July:

GST annual return (GSTR-9) filed

All ROC filings completed

Year-end closure complete

Key Takeaways

Year-end book closing is NOT just accounting compliance – it’s your business health checkup, audit preparation, and strategic planning tool rolled into one.

Do it right, and you get:

✅ Clean, audit-ready books

✅ Zero or minimal audit queries

✅ Accurate tax liability (no surprises)

✅ Strong financial statements for loans/funding

✅ Zero notice risk from GST and Income Tax

✅ Clear visibility into business performance

✅ Data-driven decisions for next year

Do it wrong or skip it, and you face:

❌ Audit delays and increased costs

❌ GST and Income Tax notices

❌ Penalty and interest demands

❌ Inaccurate financials affecting decisions

❌ Blocked ITC and refunds

❌ Damaged credibility with banks and investors

The choice is yours. But remember: messy books today mean expensive problems tomorrow.

Frequently Asked Questions (FAQs)

Q1: What exactly is year-end books closing?

Year-end books closing is the process of finalizing all financial transactions for the fiscal year (April-March in India), reconciling all accounts, preparing accurate financial statements, and ensuring compliance with GST, Income Tax, and other statutory requirements. It’s the foundation for tax filing, audits, and strategic planning.

Q2: When should I start the year-end closing process?

Ideally, start in early April – as soon as the fiscal year ends. Don’t wait until July when filing deadlines approach. Early start gives you time to identify issues, obtain confirmations, and complete reconciliations without stress.

Q3: Why is GSTR-2B reconciliation so critical?

Because GSTR-2B is the ONLY basis for claiming ITC (Input Tax Credit). If you claim ITC based on your purchase register without matching it to 2B, you’ll face mismatch notices and ITC reversal demands with 18% interest. This can block lakhs of rupees in working capital.

Q4: What happens if I don’t close my books properly?

You’ll face:

- GST mismatch notices and ITC disallowance

- Income Tax scrutiny and additions

- Audit delays and increased fees

- Penalties, interest, and late fees

- Inaccurate financial statements affecting business decisions

- Difficulty in getting loans or attracting investors

- Compliance stress carrying forward to next year

Q5: Can I close books myself or do I need a CA?

For simple businesses (small turnover, few transactions), you can do basic closing yourself using accounting software. However, for:

- GST-registered businesses with high volume

- Businesses requiring tax audit

- Complex transactions and multiple reconciliations

- Companies and LLPs with statutory audit requirements

Professional CA support is highly recommended to ensure compliance and accuracy.

Q6: What’s the difference between financial year-end and accounting year-end?

In India, the financial year is fixed: April 1 to March 31. This is when most businesses close their books. However, some businesses (especially with foreign parents) may have different accounting year-ends (calendar year: Jan-Dec). You must close books as per your registered accounting year.

Q7: How long does the year-end closing process take?

Depends on business complexity:

- Simple proprietorship: 1-2 weeks

- Small company with basic transactions: 3-4 weeks

- Medium business with multiple locations: 4-6 weeks

- Complex business with multiple entities: 6-8 weeks

Starting early and maintaining good monthly records significantly reduces time.

Q8: What if I discover errors after closing the books?

You can make corrections:

- Before audit: Relatively easy, just pass rectification entries

- After audit but before ITR filing: Inform auditor, get revised report

- After ITR filing: Requires revised return filing (only for specific errors)

Prevention is better – thorough review before finalization saves headaches.

Q9: Should I reconcile GST monthly or only at year-end?

Monthly reconciliation is far superior. Waiting until year-end means:

- 12 months of errors pile up

- Vendor compliance issues go undetected

- Missed ITC opportunity (some invoices have time limits)

- Massive last-minute stress

Monthly reconciliation catches issues when they’re fresh and fixable.

Q10: What documents should I keep after closing books?

Maintain for 7 years (some items 8 years):

- All invoices (sales and purchase)

- Bank statements

- GST returns and challans

- TDS returns and certificates

- Financial statements

- Audit reports

- Tax return acknowledgments

- Supporting vouchers and bills

- Contracts and agreements

- Ledger prints

Q11: Can I change my accounting method during year-end closing?

Generally, no. Accounting methods (cash vs accrual, inventory valuation method, depreciation method) should be consistent year-to-year. Changes require:

- Disclosure in financial statements

- Justification for the change

- Adjustment entries

- May attract scrutiny

Only change if there’s a compelling business reason, not just for tax benefit.

Q12: What’s the penalty for late finalization of books?

There’s no direct penalty for late book closing itself, but consequences include:

- Late GST annual return (GSTR-9): ₹100/day (₹50 CGST + ₹50 SGST)

- Late Income Tax return: ₹5,000 (or ₹1,000 if income < ₹5 lakh)

- Late audit report submission: ₹1,500/day (up to the amount of audit fee)

- Delayed statutory filings with ROC: ₹100/day penalty

Plus interest on tax payments delayed.

Q13: How do I handle transactions that span two financial years?

Accrual basis:

- Revenue: Recognize when earned (invoice date), not when paid

- Expenses: Recognize when incurred, not when paid

- Adjusting entries needed for:

- Advance received (liability until delivered)

- Advance paid (asset until received)

- Expenses due but not paid (provision)

- Income earned but not received (accrued income)

Cut-off date matters: Transactions dated March 31 or before belong to FY 2024-25, even if payment happens in April.

Q14: What should I do if my vendors don’t provide balance confirmations?

Try multiple methods:

- Email formal confirmation requests

- Call and follow up

- Send via registered post

- Use WhatsApp/other channels

If still no response:

- Document your attempts (keep email trails)

- Reconcile based on your ledger

- Make a note in your books

- Consider it during audit discussions

- For significant amounts, consider alternative verification

Q15: How can I make next year’s closing easier?

Build these habits:

- Monthly bank reconciliation (don’t accumulate)

- Monthly GST reconciliation (2B matching)

- Quarterly TDS reconciliation with 26AS

- Digital documentation (scan all invoices, bills)

- Use good accounting software with automation

- Maintain a monthly checklist

- Review financials quarterly

- Keep vendor/customer database updated

- Document policies and procedures

Clean monthly books make year-end closing routine instead of crisis.

Final Word:

Year-end books closing is your opportunity to:

- Clean up the entire year’s financial data

- Ensure perfect compliance

- Prepare for smooth audit

- Make informed strategic decisions

Treat it as an investment in your business’s financial health, not just a compliance burden. The businesses that close their books meticulously are the ones that scale successfully, raise funding easily, and sleep peacefully during tax season.

Start early, follow this checklist systematically, and you’ll transform year-end from chaos to control.

Still have questions? Contact AdvoFin Consulting for consultation.

📧 Email: info@advofinconsulting.com

📞 Phone: +91-92116-76467

🌐 Website: www.advofinconsulting.com

Disclaimer: This blog is for educational purposes only and does not constitute professional advice. Consult a qualified professional for specific situations.