Internal Controls for Small Businesses — Complete Founder’s Guide (Fraud Prevention, Compliance & Growth 2025)

Introduction: The ₹22 Lakh Fraud That Could Have Been Prevented Sunil’s story (real case, name changed): Sunil runs a mid-sized electrical equipment trading business (₹12 crore annual turnover, 25 employees). One Monday morning, March 2024: Bank calls: “Sir, your account balance is ₹8 lakhs. But you have ₹35 lakhs worth of cheques bouncing today.” Sunil: […]

How to Read Financial Statements — Complete Founder’s Guide (P&L, Balance Sheet & Cash Flow Explained 2025)

Introduction: The ₹40 Lakh Loss Hidden in “Profitable” Books Rajesh’s story (real case, name changed): Rajesh runs a mid-sized manufacturing business (₹8 crore annual turnover). Every month, his CA shows him: But reality: Rajesh’s confusion: “If we’re profitable, where’s the cash?” Fast forward 18 months: Crisis: Working capital shortage of ₹40 lakhs. Business on verge […]

Cash Transaction Rules in India — Complete Compliance Guide (Limits, Penalties & Smart Practices 2025)

Introduction: The ₹5 Lakh Penalty for a ₹2.5 Lakh Cash Receipt Anil’s story (real case, name changed): Anil runs a small electronics retail shop in Pune. Monthly turnover: ~₹15 lakhs. One day in March 2024: A corporate client walks in, wants to buy 10 laptops for office (₹2,50,000 total). Client: “Can I pay cash? I’ll […]

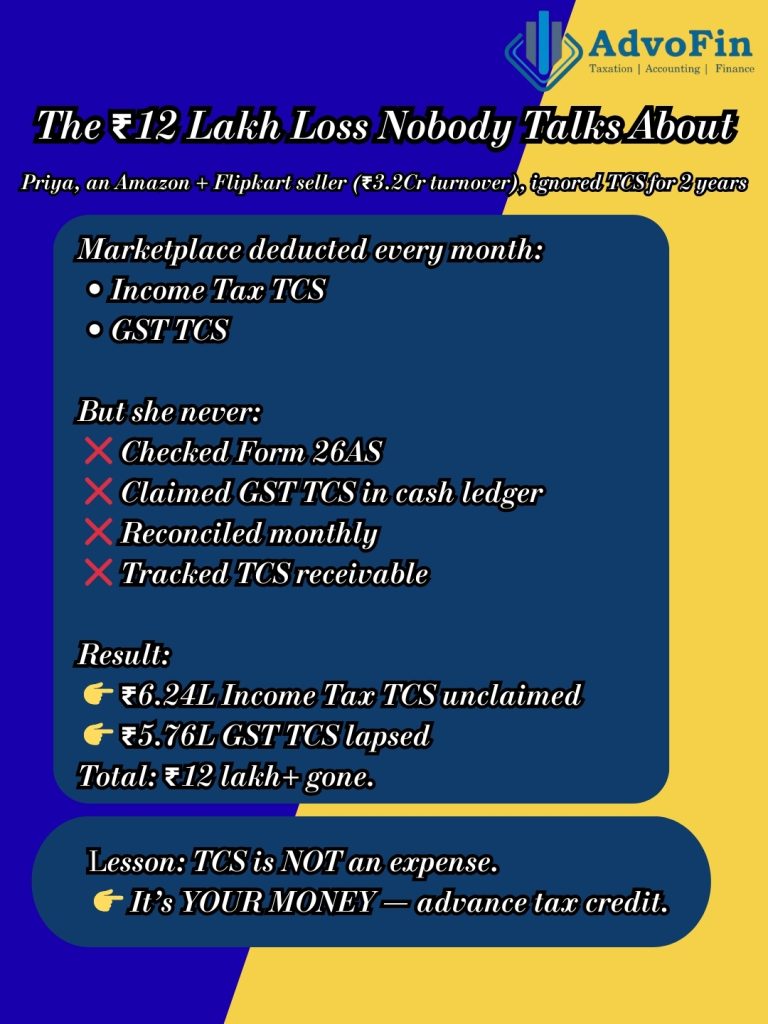

TCS Compliance for E-Commerce Sellers — Complete 2025 Guide (Income Tax + GST + Reconciliation Strategy)

Introduction: The ₹3.2 Lakh Tax Credit Lost in Confusion Priya’s story (real case, name changed): Priya runs a successful fashion accessories business on Amazon and Flipkart. Annual sales: ₹3.2 crores. Every month, she notices deductions in her settlement reports: She assumes: “This is tax I’m paying. Nothing I can do about it.” She never: Fast […]

Income Tax Notices in India — Complete Guide (Types, Reasons, Response Strategy & Prevention 2025)

Introduction: The Sunday Morning Email That Ruins Your Week Rajat’s story (real case, name changed): Sunday, 9:30 AMRajat, founder of a ₹8-crore e-commerce business, opens his email while having breakfast. Subject: “Income Tax Notice u/s 143(1) – Discrepancy in Return – Action Required” His heart sinks. Questions flood: He spends the entire Sunday Googling, reading […]

GST Anti-Evasion — Complete Defense Guide for Businesses (How to Respond, What to Prepare & Common Triggers 2025)

Introduction: The 10 PM Phone Call That Changed Everything Sameer’s story (real case, name changed): 10:15 PM, FridaySameer, founder of a ₹12-crore manufacturing business, receives a call from an unknown Delhi number. Caller: “This is GST Anti-Evasion Wing. We need to verify some transactions. Can you come to our office on Monday with all your […]

How to Handle GST Summons — Complete Founder’s Guide (Do’s, Don’ts & Response Strategy 2025)

Introduction: The 3 AM Email That Terrifies Every Founder Rahul’s story (real case, name changed): 3:15 AM, TuesdayRahul, founder of a ₹5-crore e-commerce business, wakes up to check emails (entrepreneur insomnia). Subject: “Summons u/s 70 of CGST Act – Appearance Required – 7 Days” His heart races. Questions flood his mind: He doesn’t sleep the […]

Repatriation Rules for NRIs — Complete 2025 Guide (FEMA + Tax + Banking + Step-by-Step Process)

Introduction: The $200,000 Stuck in India (A Real NRI Story) Priya’s nightmare (real case, name changed): Priya, an NRI in Canada since 2015, sold her Mumbai flat in March 2024 for ₹1.6 crores (~$200,000). She was thrilled—until she tried to transfer the money to Canada. What went wrong: ❌ Mistake 1: Sale proceeds deposited in […]

NRI Income Tax Filing Requirements — Complete 2025 Guide (With Residency Rules, TDS Rates & DTAA Benefits)

Introduction: The ₹8 Lakh Mistake Most NRIs Make (And How to Avoid It) Real case (anonymized): Rajesh, a software engineer in the US since 2019, owns a flat in Mumbai that he rents out for ₹40,000/month (₹4.8L annually). His tenant dutifully deducts 31.2% TDS (₹1.5 lakhs) and deposits it to the government. Rajesh thinks: “TDS […]

LUT Filing for Exporters — Complete 2025 Guide (GST Zero-Rated Supply Made Simple)

Introduction: The ₹50,000 Mistake 70% of Exporters Make Every April Real scenario (happens every year): April 5, 2025A Bangalore-based SaaS startup invoices their first US client of the new financial year: $10,000 (₹8.5 lakhs). Founder thinks: “We’re exporters, GST is 0%.” Invoice raised at 0% GST. Payment received. Everyone’s happy. July 2025GST notice arrives: “Export […]