GST Anti-Evasion — Complete Defense Guide for Businesses (How to Respond, What to Prepare & Common Triggers 2025)

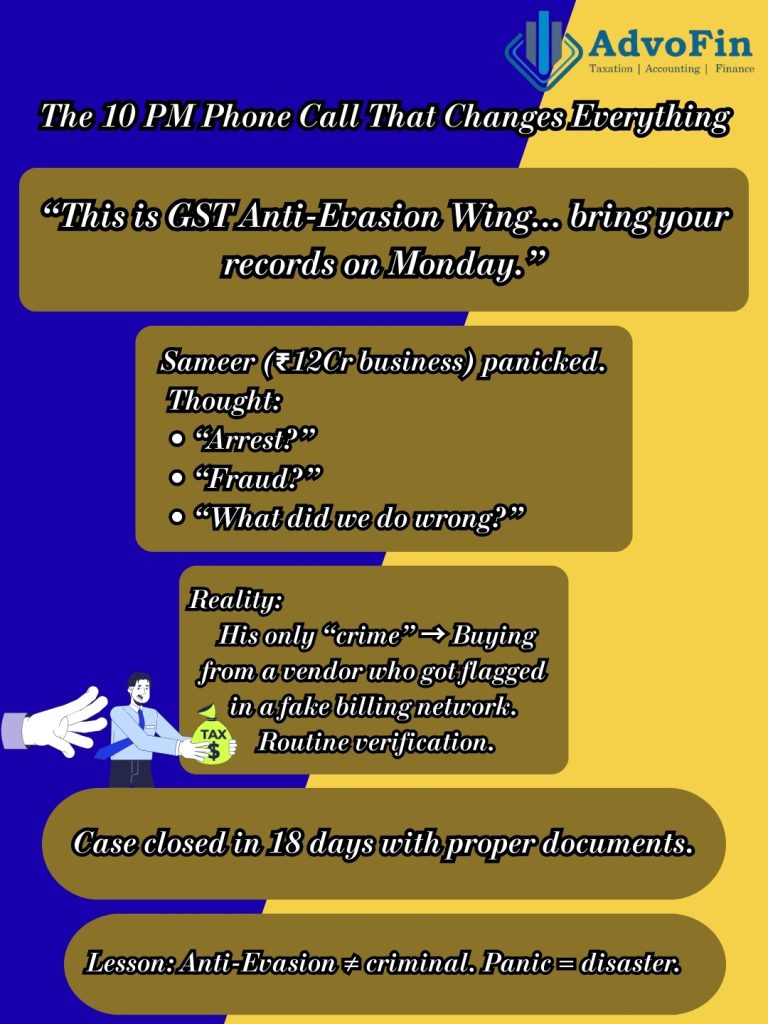

Introduction: The 10 PM Phone Call That Changed Everything Sameer’s story (real case, name changed): 10:15 PM, FridaySameer, founder of a ₹12-crore manufacturing business, receives a call from an unknown Delhi number. Caller: “This is GST Anti-Evasion Wing. We need to verify some transactions. Can you come to our office on Monday with all your […]

How to Handle GST Summons — Complete Founder’s Guide (Do’s, Don’ts & Response Strategy 2025)

Introduction: The 3 AM Email That Terrifies Every Founder Rahul’s story (real case, name changed): 3:15 AM, TuesdayRahul, founder of a ₹5-crore e-commerce business, wakes up to check emails (entrepreneur insomnia). Subject: “Summons u/s 70 of CGST Act – Appearance Required – 7 Days” His heart races. Questions flood his mind: He doesn’t sleep the […]

LUT Filing for Exporters — Complete 2025 Guide (GST Zero-Rated Supply Made Simple)

Introduction: The ₹50,000 Mistake 70% of Exporters Make Every April Real scenario (happens every year): April 5, 2025A Bangalore-based SaaS startup invoices their first US client of the new financial year: $10,000 (₹8.5 lakhs). Founder thinks: “We’re exporters, GST is 0%.” Invoice raised at 0% GST. Payment received. Everyone’s happy. July 2025GST notice arrives: “Export […]

Export of Services — Complete GST, Income Tax & FEMA Guide (2025 Edition)

Introduction: India’s Service Export Boom & The Compliance Gap India’s service exports have crossed $340+ billion annually (FY 2023-24), making the country a global powerhouse in: Who’s driving this growth? But here’s the problem: Every month, thousands of service exporters—from solo freelancers to established agencies—make costly compliance mistakes: ❌ Paying 18% GST unnecessarily (when it […]

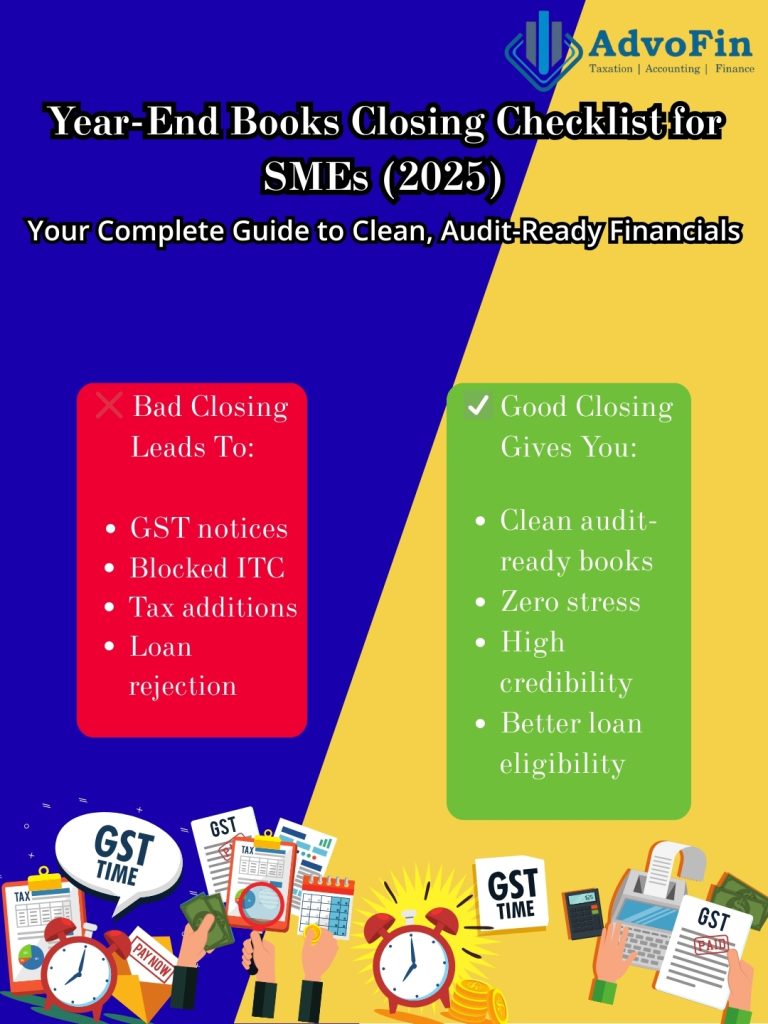

Year-End Books Closing Checklist for SMEs – Your Complete Guide to Clean, Audit-Ready Financials

Introduction: Why Year-End Closing Determines Your Business Health Most Indian businesses treat year-end book closing as a routine accounting task – something to rush through so they can file their returns and move on. This is a costly mistake. Year-end book closing isn’t just about compliance. It’s your business’s annual health report that determines: In […]

Presumptive Taxation vs Normal Taxation – Which System Saves You More Tax in 2025?

Introduction If you’re a small business owner, freelancer, consultant, or professional, you’ve likely asked yourself: Should I opt for presumptive taxation or stick with normal taxation? This isn’t just an accounting question – it’s a strategic financial decision that affects: Choose wrong, and you could end up paying unnecessary taxes, missing legitimate deductions, or creating […]

GST for Traders – Critical Mistakes That Inflate Your Tax Liability

Introduction If you run a trading business – whether you’re a wholesaler, distributor, importer, exporter, or multi-state trader – you’re already on the GST department’s radar. Why? Because tracking physical goods is far easier than tracking services. Your business involves: Each of these creates potential compliance gaps that can trigger notices, block your working capital, […]

GST for Service Providers – The Complete 2025 Practical Guide

Introduction: Why This Matters to You Running a service business in India? Whether you’re a freelance consultant, digital agency owner, IT professional, or startup founder, GST isn’t just another compliance checkbox—it directly impacts your cash flow, client relationships, and audit risk. Here’s the uncomfortable truth: Service providers face more GST scrutiny, make more costly mistakes, […]

The Hidden E-Way Bill Mistakes Costing Indian Businesses Lakhs in Penalties

The ₹2 Lakh Mistake That Could Have Been Avoided Last month, a Bangalore-based electronics distributor lost ₹2.18 lakhs in a single day. Not due to fraud. Not due to tax evasion. But because their delivery vehicle was stopped at a state border checkpoint with an expired E-Way Bill. The goods were worth ₹4.36 lakhs. The […]

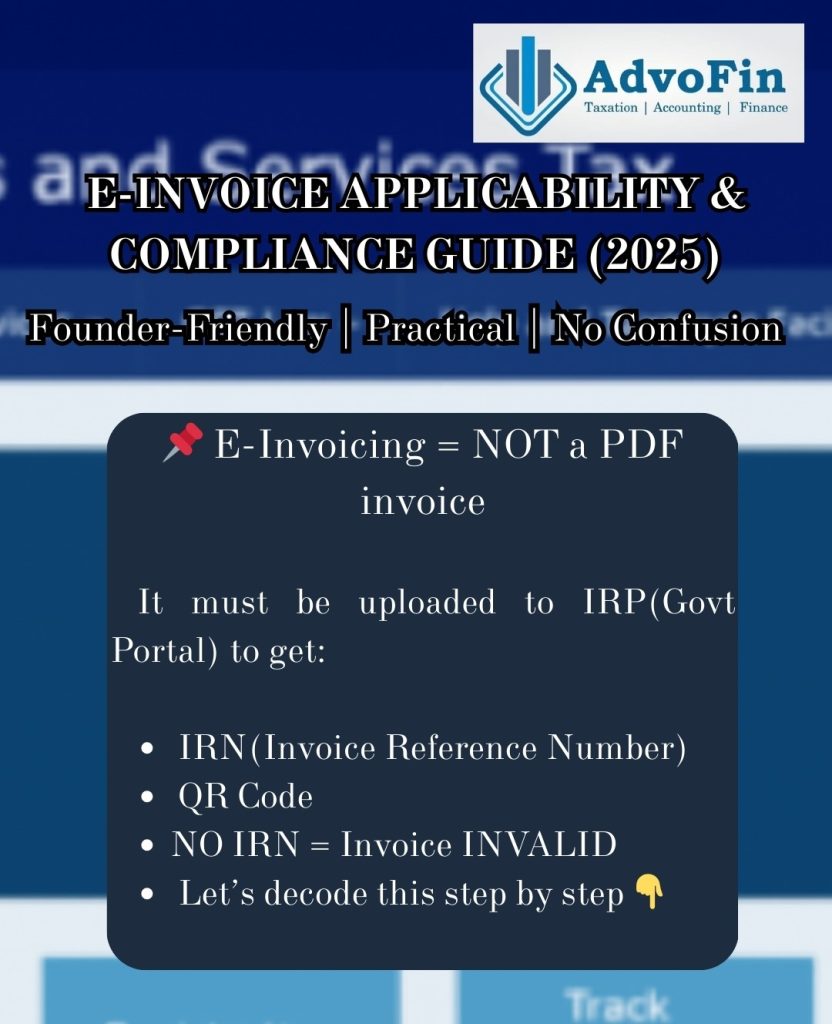

E-Invoice Applicability & Compliance Guide – The Complete Playbook for Indian Businesses

Introduction E-invoicing isn’t just another compliance checkbox—it’s fundamentally changed how Indian businesses report transactions under GST. What began with enterprises earning ₹500 crore+ has now reached businesses at ₹5 crore turnover, affecting thousands of MSMEs. If you’re a founder, CFO, or accountant wondering whether e-invoicing applies to you—or how to implement it without breaking your […]