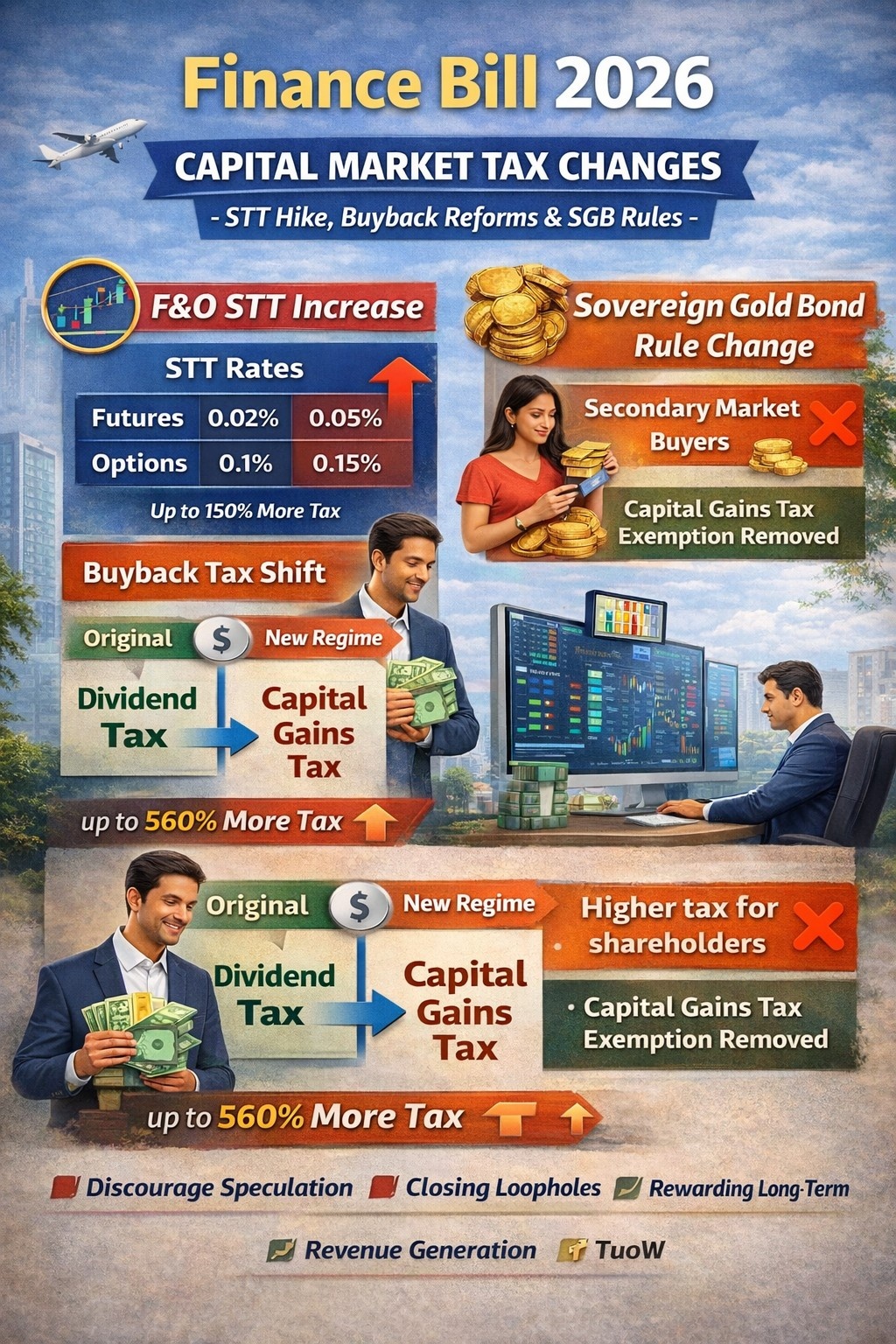

Significant changes in securities taxation aim to curb speculation, close tax arbitrage loopholes, and rationalize gold bond benefits. Here’s the complete breakdown:

SECURITIES TRANSACTION TAX (STT) – STEEP INCREASE ON F&O

Rate Changes Effective FY 2026-27

Major hike targeting speculative trading

| Transaction Type | Old STT Rate | New STT Rate | % Increase |

| Futures – Sale | 0.02% | 0.05% | 150% ↑ |

| Options – Sale of Option (Premium) | 0.1% | 0.15% | 50% ↑ |

| Options – Exercise (on settlement) | 0.125% of intrinsic value | 0.15% of intrinsic value | 20% ↑ |

| Equity Delivery | 0.1% (each side) | 0.1% (unchanged) | – |

| Equity Intraday | 0.025% (sell side) | 0.025% (unchanged) | – |

Impact Analysis – How Much More You Pay

Example 1: Futures Trading

Trade Details:

- Nifty Futures lot size: 25

- Entry: 24,000

- Exit: 24,500

- Contract value: ₹6,12,500

STT Calculation (Sell Side):

| Parameter | Old Regime | New Regime | Extra Cost |

| STT Rate | 0.02% | 0.05% | – |

| STT Amount | ₹122.50 | ₹306.25 | +₹183.75 |

Per lot extra: ₹184

10 lots/day: ₹1,840 extra per day

Monthly (20 days): ₹36,800 extra

Example 2: Options Selling (Premium Collection)

Trade Details:

- Bank Nifty Weekly Options

- Sold 48,000 CE at ₹150 premium

- Lot size: 15

- Premium collected: ₹2,250

STT on Premium (Sell Side):

| Parameter | Old Regime | New Regime | Extra Cost |

| STT Rate | 0.1% | 0.15% | – |

| STT Amount | ₹2.25 | ₹3.38 | +₹1.13 |

Seems small? Let’s scale:

- 100 lots/week: ₹113 extra

- Monthly (4 weeks): ₹452 extra

- Annually: ₹5,400 extra per 100 lots strategy

Example 3: Options Exercise (ITM Settlement)

Trade Details:

- Nifty 24,000 Call Option exercised

- Strike: 24,000 | Spot at expiry: 24,300

- Intrinsic value: ₹300 × 25 lots = ₹7,500

STT on Exercise:

| Parameter | Old Regime | New Regime | Extra Cost |

| STT Rate | 0.125% | 0.15% | – |

| STT on Intrinsic Value | ₹9.38 | ₹11.25 | +₹1.87 |

Who Gets Hit Hardest?

– High-Frequency F&O Traders:

- Intraday futures scalpers

- 150% STT increase = direct hit on thin margins

- Break-even now requires bigger moves

– Options Sellers (Premium Writers):

- Weekly expiry sellers

- 50% STT hike on premium = reduced profitability

- Credit spreads, iron condors more expensive

– Algo/HFT Traders:

- Volume-based strategies

- STT cost now material component of P&L

- May force shift to cash/delivery

– Delivery Investors – Untouched:

- STT on equity delivery: No change

- Long-term investors not impacted

Government’s Stated Objective

Curb Excessive Speculation:

– F&O turnover in India: ₹17,000+ lakh crore/year (FY 2024-25)

– 90% of retail F&O traders lose money (SEBI study)

– STT hike = disincentive for excessive leverage

Policy Intent:

- Reduce retail participation in risky derivatives

- Channel savings toward productive investment

- Increase tax revenue from speculative activity

SHARE BUYBACK TAXATION – FUNDAMENTAL SHIFT

From Dividend Tax to Capital Gains Tax

Effective: FY 2026-27

Old Regime (Till FY 2025-26):

Step 1: Company announces buyback at ₹500/share (face value ₹10)

Step 2: Company pays DDT @ 20% on deemed dividend (₹500 – ₹10 = ₹490)

Step 3: Shareholder receives buyback proceeds tax-free in their hands

Tax burden: Entirely on company

New Regime (From FY 2026-27):

Step 1: Company announces buyback at ₹500/share (no DDT)

Step 2: Shareholder receives ₹500 Step

3: Shareholder pays capital gains tax on (₹500 – acquisition cost)

Tax burden: Shifted to shareholder

Tax Rate Comparison

| Shareholder Type | Holding Period | Tax Rate | Effective Incidence |

| Promoter (Individual) | Any | LTCG/STCG + Special 30% levy | ~30% |

| Promoter (Company) | Any | Capital gains + 22% additional levy | ~22% |

| Non-Promoter (Individual) | >1 year | LTCG @ 12.5% (>₹1.25L) | 12.5% |

| Non-Promoter (Individual) | <1 year | STCG @ 20% | 20% |

| FII/FPI | >1 year | LTCG @ 12.5% | 12.5% |

| Domestic Institution | Any | As per applicable IT rate | Varies |

Example: Buyback Tax Impact

Company: XYZ Ltd announces buyback at ₹1,000/share

Shareholder: Mr. Kapoor (non-promoter individual)

Original purchase price: ₹400 (bought 3 years ago)

Shares tendered: 1,000 shares

Calculation:

Total consideration received: 1,000 × ₹1,000 = ₹10,00,000

Cost of acquisition: 1,000 × ₹400 = ₹4,00,000

Capital gains: ₹10,00,000 – ₹4,00,000 = ₹6,00,000

Tax liability (LTCG):

- Exempt: ₹1,25,000

- Taxable: ₹4,75,000

- Tax @ 12.5%: ₹59,375

Net proceeds: ₹10,00,000 – ₹59,375 = ₹9,40,625

Old Regime (For Comparison):

DDT paid by company: 20% × ₹6,00,000 = ₹1,20,000

Tax on shareholder: Nil

Net proceeds to shareholder: ₹10,00,000 (full amount)

Difference: Shareholder now bears ₹59,375 tax burden directly

Why This Change?

Tax Arbitrage Closure:

Old Loophole:

- Promoter sells shares in open market → pays 12.5% LTCG tax

- Company does buyback → promoter pays 0% tax (company pays DDT)

- Promoters preferred buyback route to extract cash tax-efficiently

New System:

- Buyback and open-market sale both attract capital gains tax

- 30% special levy on promoters makes buyback unattractive for cash extraction

- Levels playing field between dividend and buyback

Impact on Corporate Strategy

Companies may prefer:

– Dividends instead of buybacks (no special levy)

– Special dividends for cash distribution

– Bonus shares for rewarding shareholders

Buybacks will reduce except for genuine capital restructuring

SOVEREIGN GOLD BONDS (SGB) – EXEMPTION RESTRICTED

New Taxation Rules (Effective 1 April 2026)

Amendment: Restricts Capital Gains Exemption

What Are SGBs?

- Government-issued gold-backed securities

- 8-year maturity (exit option from 5th year)

- 2.5% p.a. interest (taxable)

- Tradable on stock exchanges

OLD TAX TREATMENT (Till FY 2025-26):

– Redemption at maturity (8 years): Fully exempt from capital gains tax

– Sold before maturity (secondary market): LTCG @ 12.5% (if held >3 years)

– Interest: Taxable as “income from other sources”

NEW TAX TREATMENT (From FY 2026-27):

Exemption ONLY if ALL conditions met:

- Subscribed at original RBI issue (not bought from secondary market)

- Held continuously from subscription date

- Redeemed at maturity (8 years)

Scenarios Under New Rules

| Scenario | Tax Treatment |

| ✅ Subscribed at RBI issue + held till maturity (8 years) | Fully exempt |

| ❌ Subscribed at issue but sold in 6th year (secondary market) | LTCG @ 12.5% (no exemption) |

| ❌ Bought from secondary market + held till maturity | LTCG @ 12.5% (no exemption) |

| ❌ Premature redemption (5th/6th/7th year via RBI window) | LTCG @ 12.5% (no exemption) |

Example: Impact on Secondary Market Buyers

Investor: Mrs. Gupta

Action: Bought SGB from NSE in 2021 at ₹5,000/unit

Maturity: 2029 (8 years from original issue)

Redemption value at maturity (2029): ₹7,500/unit

Units: 10

Tax Calculation (New Rules):

Capital gains: (₹7,500 – ₹5,000) × 10 = ₹25,000

Exempt: Nil (bought from secondary market)

Taxable LTCG: ₹25,000 – ₹1,25,000 (exemption limit) = Nil

Tax: Nil (falls within basic exemption)

But if gains were ₹2,00,000:

Taxable: ₹2,00,000 – ₹1,25,000 = ₹75,000

Tax @ 12.5% = ₹9,375

Old Rules (For Comparison):

Even secondary market buyers got full exemption at maturity

Tax: Nil

Difference: Now pays ₹9,375 tax on same transaction

Example: Impact on Premature Sellers

Investor: Mr. Joshi

Action: Subscribed SGB in 2020 at ₹4,800/unit

Sold in 2026 (6th year) at ₹6,500/unit

Units: 20

Tax Calculation:

Capital gains: (₹6,500 – ₹4,800) × 20 = ₹34,000

Holding: >3 years = LTCG

Exempt: Nil (sold before maturity)

Taxable: ₹34,000 (within ₹1.25L basic exemption)

Tax: Nil (assuming no other capital gains)

Old rule: Would’ve been exempt if held till maturity

New rule: Must pay tax if sold early

Who Gets Hit?

– Secondary market SGB buyers:

- Bought from exchange/peers

- No exemption even if held till original maturity

- Defeats purpose of buying from secondary market

– Investors needing liquidity:

- Exit in 5th/6th/7th year

- Lose exemption benefit

- Forced to pay LTCG tax

– Estate planning cases:

- SGBs inherited or gifted

- Continuity broken

- No exemption for heirs at maturity

– Original subscribers holding till maturity:

- Fully exempt (unchanged)

- 8-year lock-in gets reward

Policy Rationale

Government’s Logic:

- SGBs meant as long-term gold investment alternative

- Tax benefit should reward patient capital (8-year holders)

- Secondary market trading = speculative activity (shouldn’t get exemption)

- Aligns with original scheme intent (reduce physical gold demand)

COMPARATIVE TAX SUMMARY

Capital Market Instruments – Tax Treatment (FY 2026-27)

| Instrument | Holding Period | Tax Rate | Special Notes |

| Equity (Delivery) | <1 year | STCG @ 20% | + STT (unchanged) |

| Equity (Delivery) | >1 year | LTCG @ 12.5% (>₹1.25L) | + STT (unchanged) |

| Futures (Sale) | Any | Business income / STCG @ 20% | + STT 0.05% (↑150%) |

| Options (Premium) | Any | Business income / STCG @ 20% | + STT 0.15% (↑50%) |

| Buyback (Promoter) | Any | 30% special levy | New regime |

| Buyback (Non-promoter) | >1 year | LTCG @ 12.5% | Shifted from DDT |

| SGB (Original subscriber, maturity) | 8 years | Exempt | Unchanged |

| SGB (Secondary/premature) | >3 years | LTCG @ 12.5% | Exemption removed |

| Physical Gold | >3 years | LTCG @ 12.5% (no indexation) | Unchanged |

INVESTMENT STRATEGY SHIFTS

For F&O Traders:

– What’s Costlier Now:

- High-frequency futures scalping (150% STT hike)

- Weekly options selling (50% STT hike)

- Algo trading with thin margins

– What to Consider:

- Longer-duration options (reduce trade frequency)

- Larger price targets to absorb STT

- Shift partial capital to delivery/positional

- Review breakeven calculations (STT now material)

For Long-Term Equity Investors:

– Good News:

- No impact on delivery trades (STT unchanged)

- LTCG rate unchanged @ 12.5%

- Buyback changes don’t affect minority shareholders much

– Strategy:

- Continue SIP/delivery-based investing

- Avoid F&O speculation (costlier now)

For SGB Investors:

– If you already hold SGBs:

- Original subscribers: Hold till maturity (exemption intact)

- Secondary market buyers: Consider tax liability at maturity (12.5% LTCG)

– Future SGB strategy:

- Avoid secondary market purchase (lose exemption benefit)

- Subscribe only at RBI issue (if planning 8-year hold)

- Consider physical gold/Gold ETF if need liquidity (no false exemption promise)

– Current series:

- SGB 2024-25 Series I, II, III still open periodically

- Subscribe directly from RBI/banks/designated platforms

- Plan for 8-year horizon

For Companies Planning Buyback:

– Buyback now less attractive:

- Shareholders (especially promoters) pay higher tax

- May prefer dividend route for cash distribution

– When buyback still makes sense:

- Capital restructuring (reduce share capital)

- Support stock price (market conditions)

- Not for tax arbitrage (loophole closed)

Finance Bill 2026’s Capital Market Changes Are About:

- Discouraging Speculation – Higher STT makes F&O expensive

- Closing Loopholes – Buyback tax arbitrage eliminated

- Rewarding Long-Term – SGB exemption only for patient capital

- Revenue Generation – Government earns more from speculative activity