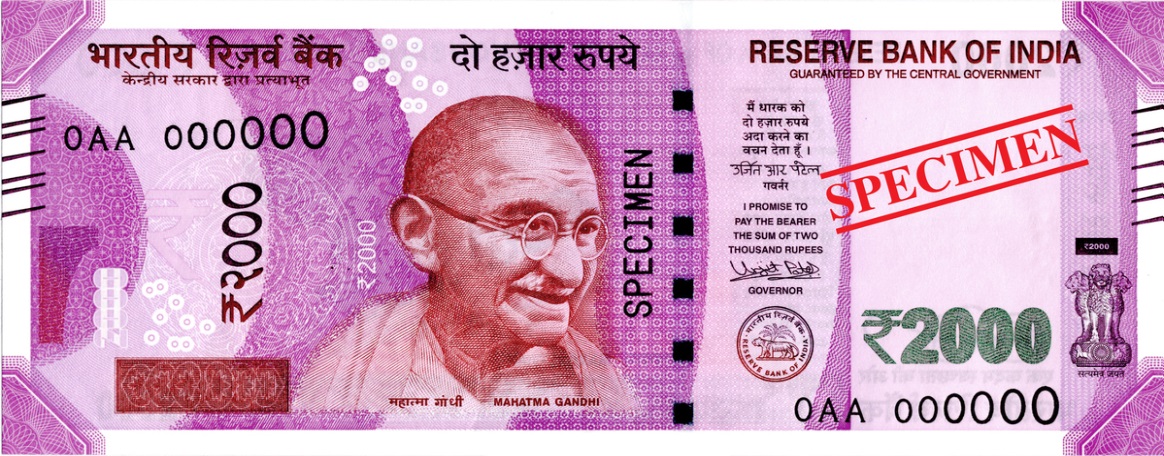

Banks to Report Large Cash Deposits of ₹2,000 Notes: A Step Towards Ensuring Tax Compliance

In a bid to combat tax evasion and promote transparency in financial transactions, banks in India have been directed to notify the income tax department about significant cash deposits involving ₹2,000 currency notes above a specified threshold. This reporting requirement falls under the statement of financial transactions (SFT) that banks are mandated to submit annually.