In a surprising move, the Reserve Bank of India (RBI) has recently announced the withdrawal of Rs 2,000 denomination notes from circulation. This decision has raised eyebrows and sparked discussions among the general public and financial experts alike. In this blog post, we will delve into the reasons behind this unexpected step, its potential impact on the economy, and what it means for the common man.

Reasons for the Withdrawal: The RBI has cited several reasons for withdrawing the Rs 2,000 notes from circulation. One of the primary motives is to curb the circulation of high-value currency and discourage black money transactions. The demonetization exercise in 2016, which saw the withdrawal of Rs 1,000 and Rs 500 notes, aimed to achieve a similar objective. The decision to withdraw the Rs 2,000 notes is seen as a continuation of those efforts.

Impact on Black Money and Counterfeit Currency: The withdrawal of the Rs 2,000 notes is expected to have a significant impact on black money hoarders and counterfeit currency operators. As the denomination has a higher value, it facilitates the storage and movement of large sums of illicit money. By eliminating this denomination, the RBI hopes to make it more difficult for those involved in illegal activities to store and transact with such large amounts of cash.

Additionally, the Rs 2,000 notes were found to be more susceptible to counterfeiting compared to lower denomination notes. The absence of these higher denomination notes will likely reduce the circulation of counterfeit currency, making it easier for law enforcement agencies to track and apprehend offenders.

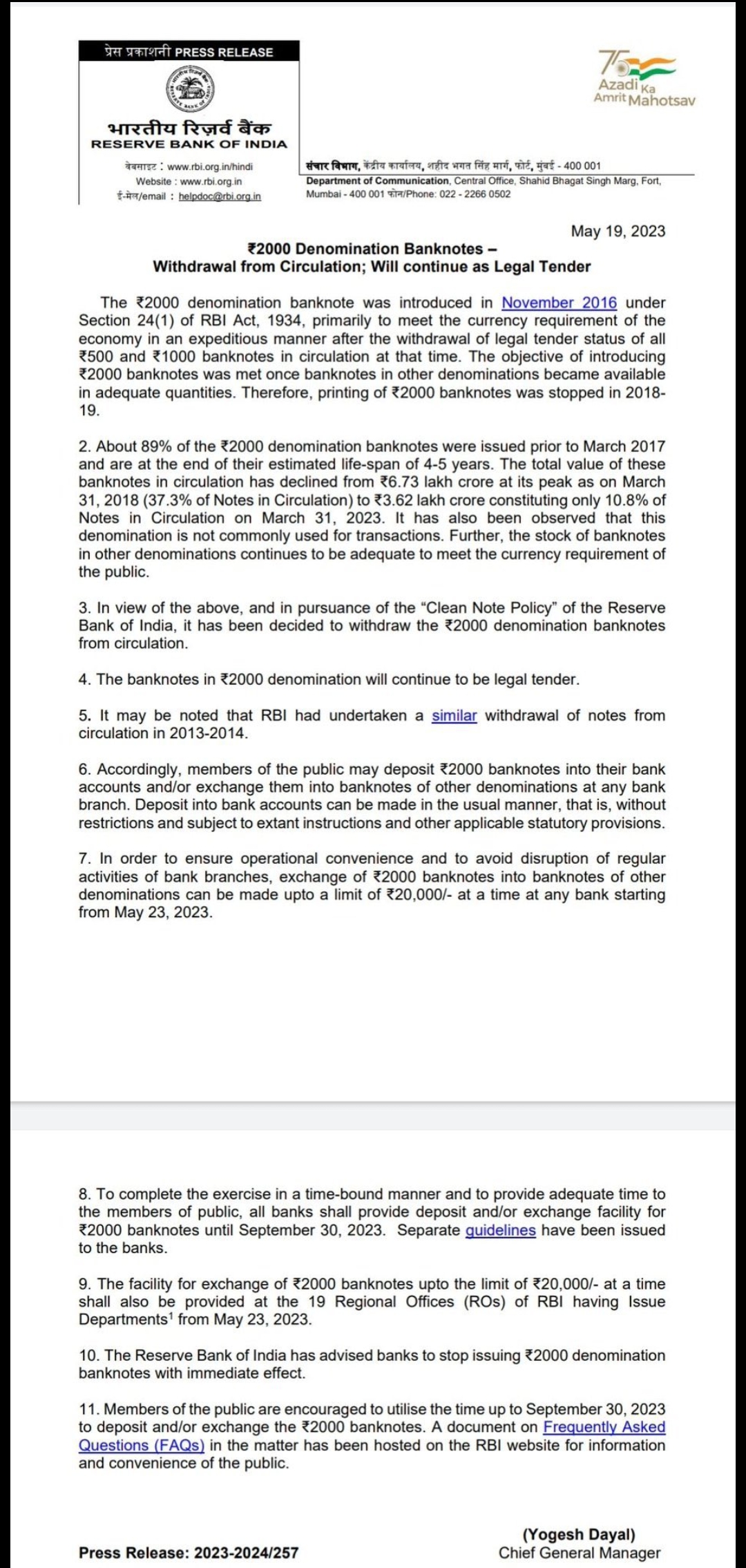

Transition and Replacement: To facilitate a smooth transition, the RBI has assured the public that the existing Rs 2,000 notes will remain legal tender and can be exchanged or deposited at banks within a specified period. The exact timeline for the withdrawal and exchange process will be communicated by the RBI, ensuring that individuals have sufficient time to exchange their notes for lower denomination currency or deposit them into their bank accounts.

Impact on the Economy: The withdrawal of a currency denomination as widely used as the Rs 2,000 note will undoubtedly have short-term effects on the economy. There might be temporary disruptions in cash-based transactions, particularly in rural areas where digital payment infrastructure is not as prevalent. However, the long-term benefits of curbing black money and counterfeit currency are expected to outweigh these initial challenges.

Promoting Digital Payments: With the withdrawal of the Rs 2,000 notes, the RBI aims to further promote the adoption of digital payment methods. The government has been pushing for a cashless economy and encouraging citizens to use digital platforms for transactions. This move is aligned with those efforts and is expected to drive the adoption of digital payment solutions, such as mobile wallets, UPI (Unified Payments Interface), and other digital payment apps.

Conclusion: The withdrawal of Rs 2,000 notes from circulation by the RBI is a significant step towards curbing black money and counterfeit currency in India. While the decision may cause temporary disruptions, it is expected to have long-term positive impacts on the economy. By encouraging digital payments and reducing the circulation of high-value currency, the RBI aims to create a more transparent and efficient financial ecosystem. It is essential for individuals to stay informed about the process of exchanging or depositing their existing Rs 2,000 notes and embrace digital payment alternatives for a smoother transition.